Everything You Need To Know To

Apply For ERC Online

COVID-19 caused numerous challenges for business owners, including layoffs and shutdowns. To help combat these issues, the federal government introduced the Employee Retention Credit (ERC), a refundable tax credit designed to incentivize businesses to retain their employees. This article will provide you with valuable guidance on how to apply for the ERC, how to ensure your eligibility, and how to claim your tax refund.

Understanding the Employee Retention

Credit (ERC) and Its Benefits

What is the Employee Retention Credit and how does it work?

The ERC is a refundable tax credit for businesses that meet eligibility requirements and retain their employees during COVID-19. Business owners can apply for the ERC by completing an ERC tax credit application and submitting it to the Internal Revenue Service (IRS) for approval. The credit amount is based on qualified wages paid to employees during the pandemic.

Benefits of the ERC for business owners during COVID-19

The ERC provides financial relief for businesses that continue to pay their workers, despite the economic challenges presented by the pandemic. Qualifying businesses may apply for the ERC to receive partial reimbursement for payroll expenses, easing the financial burden.

The role of the CARES Act in providing the ERC as a refundable tax credit

The ERC was established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which aimed to provide economic relief for businesses and individuals affected by the pandemic. As a refundable tax credit, the ERC allows employers to receive a tax refund if their credit amount exceeds the tax owed on their tax return.

How to Determine Your Eligibility for the ERC

Qualification criteria for the Employee Retention Tax Credit

To be eligible for the ERC, businesses must experience either a significant decline in gross receipts or a full or partial shutdown due to government-imposed restrictions related to COVID-19. They must also continue to pay their employees during the crisis. Additional qualification criteria may apply depending on the tax year and specific circumstances.

Understanding qualified wages and the relevance of payroll

Qualified wages refer to the wages paid to employees during the pandemic, which are used to calculate the ERC credit amount. Payroll expenses, including employer-provided health benefits and certain other payroll-related costs, also factor into the credit calculation. Accurately tracking these expenses is crucial for the ERC application process.

Special considerations for 2021 and 2023 ERC eligibility

Special considerations affect ERC eligibility for tax years 2021 and 2023, including subtle differences in the timeline for qualifying for the ERC, as well as differing credit rates and maximum credit amounts. It's essential for business owners to consult ERC experts and IRS guidance to understand these specific eligibility requirements and ensure they qualify for the employee retention tax credit.

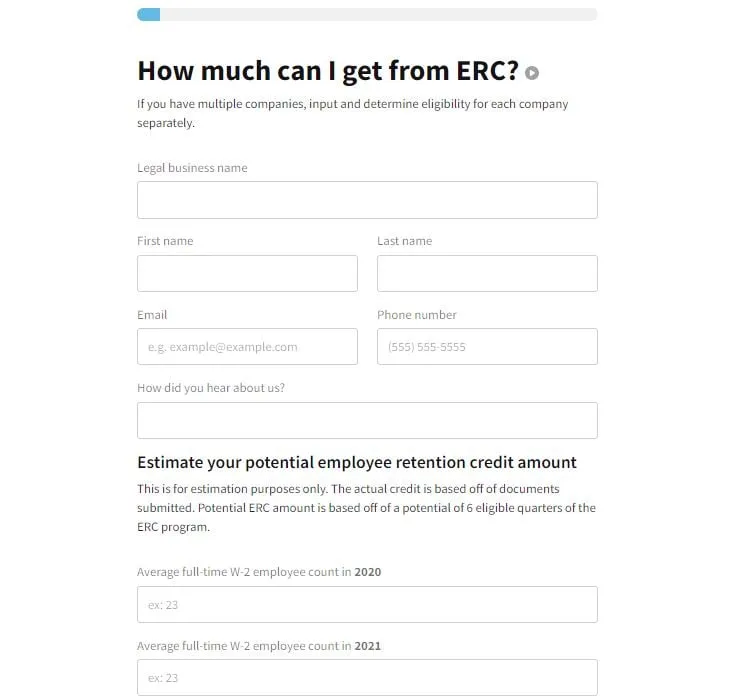

Applying for the ERC: A Step-by-Step Process

Preparing for the ERC application process

Before filing a tax credit application, businesses should review their financial records and payroll documentation to ensure they meet the eligibility criteria for claiming the ERC. They should also consult any relevant IRS guidance and engage with ERC experts to help streamline the application process to learn how to apply for the ERC correctly.

Filing your ERC tax credit application with the IRS

Businesses can apply for the ERC by filing Form 941-X, an amended quarterly payroll tax return, with the IRS. The application process includes completing the form, providing payroll records, and calculating the credit amount. It is crucial to thoroughly complete the form and attach any supporting documentation to reduce the likelihood of IRS inquiries or audits.

Ensuring the accuracy and completeness of your application

Accuracy and completeness are vital when applying for the ERC to avoid delays, rejections, or IRS penalties. Double-check all information, ensure the correct credit amount is calculated, and retain sufficient supporting documentation for reference during potential audits.

Claiming Your Employee Retention Tax Credit Refund

When and how to expect your ERC refund

After submitting the ERC tax credit application, the IRS will review the information provided and determine the tax refund amount. Businesses can expect to receive their ERC refund within a few weeks, but it's essential to follow up with the IRS if the refund is not received within a reasonable time frame.

Maintaining documentation to support your ERC claim

Business owners should retain all relevant documentation, such as payroll records and proof of qualified wages, for at least four years. Maintaining organized and easily accessible records ensures preparedness in the event of an IRS inquiry or audit regarding the ERC claim.

How to handle IRS inquiries and audits related to the ERC

If the IRS has questions or requests additional information, businesses should promptly respond with the necessary documentation to avoid delays or penalties. If facing an audit, business owners should consult with tax professionals or ERC experts to navigate the audit process and minimize potential penalties.

Exploring Other Stimulus Programs for Business Owners

Additional tax credits and financial incentives available for businesses

Aside from the ERC, other stimulus programs and tax credits are available to businesses, such as the Paycheck Protection Program (PPP), the Economic Injury Disaster Loan (EIDL), and the Work Opportunity Tax Credit (WOTC). Business owners should research these options to determine eligibility and maximize benefits during these trying times.

How the ERC compares to other stimulus efforts

The ERC is different from other stimulus programs in that it is specifically aimed at retaining employees during the pandemic. While PPP and other similar programs may provide broader financial assistance, the ERC focuses on the payroll aspect of business operations and encourages employers to maintain their workforce.

Maximizing your benefit from government relief programs

Business owners should consult with tax professionals and other experts to make informed decisions about which stimulus programs and tax credits to apply for and how to maximize their benefits. Having a clear understanding of all available options, eligibility requirements, and application processes will ensure the best chance of obtaining financial relief during the pandemic.

Frequently Asked Questions

How can I apply for the Employee Retention Credit (ERC) online?

You can apply for the ERC by filing Form 941, Employer's Quarterly Federal Tax Return, with the IRS. Make sure to include the necessary information related to your credit claim. If you need help, consider consulting with a professional who specializes in the ERC.

Am I eligible for the ERC tax credit in 2023?

The ERC was initially available for employers affected by COVID in quarters of 2020 and 2021. As of now, there is no extension of this credit for 2023. Stay updated with IRS announcements to determine your ERC eligibility in the future.

What is the ERC credit and who can claim it today?

The Employee Retention Credit (ERC) is a refundable tax credit designed to help businesses keep their employees on the payroll during the COVID-19 pandemic. Employers, including small businesses, who faced significant disruptions or declines in revenue due to COVID may be eligible to claim the employee retention credit.

What should I know before applying for ERC?

Before applying for the ERC, determine your eligibility by reviewing the IRS guidelines and considering your business's financial situation. Also, gather the necessary information such as wages paid to employees after March 12, 2020, and other relevant financial records for the credit claim.

Can I receive the employee retention tax credit without filing Form 941?

No, Form 941 is required to claim the employee retention credit. Businesses need to file Form 941, Employer's Quarterly Federal Tax Return, to report employee wages, taxes withheld, and the ERC credit claimed.

How does the ERC help small businesses during COVID?

The ERC provided financial relief for small businesses during COVID by offering a refundable tax credit based on qualified wages they paid to employees. This helped businesses maintain their workforce, even during times of disruption or reduced revenue.

How do I determine if my business qualifies for the Employee Retention Credit?

You can determine if your business qualifies for the ERC by reviewing the eligibility criteria provided by the IRS. These criteria include factors such as experiencing significant disruptions from COVID, a decline in gross receipts, and the wages paid to employees after March 12, 2020.

Can I apply for Employee Retention Credit and Paycheck Protection Program (PPP) at the same time?

Employers who receive the Paycheck Protection Program (PPP) loan may be eligible for the ERC as well. However, they cannot claim the ERC for the same wages that were considered for PPP loan forgiveness. Carefully review the guidelines to ensure compliance with both programs.

What types of businesses qualify for the ERC credit?

Businesses of all sizes, including non-profit organizations and government entities, may qualify for the ERC if they meet the specific eligibility criteria related to disruptions from COVID and a decline in gross receipts.

What wages can I claim for the Employee Retention Credit?

You can claim ERC for qualified wages, including salaries, hourly pay, tips, other taxable benefits, and the employer-paid portion of health benefits. However, double-dipping (claiming ERC for wages covered by other credits) is not allowed, and different rules apply for 2020 and 2021. Review the IRS guidelines for complete information on qualified wages.

Conclusion

In the face of the unprecedented challenges posed by the COVID-19 pandemic, the Employee Retention Credit (ERC) has emerged as a lifeline for business owners striving to keep their operations afloat while retaining their valuable workforce. Understanding the intricacies of the ERC and navigating the application process can significantly contribute to alleviating the financial burdens imposed by the crisis. By following the steps outlined in this article, businesses can effectively determine their eligibility, submit accurate and complete applications, and ultimately claim their ERC refund.

The ERC, established under the CARES Act, offers numerous benefits to eligible businesses by providing partial reimbursement for qualified wages paid during the pandemic. Recognizing the relevance of payroll expenses and the importance of accurately tracking them, businesses can ensure their application accurately reflects their entitlement to the tax credit. It is equally crucial to remain updated on specific eligibility requirements, especially for tax years 2021 and 2023, as subtle differences may influence qualification.

To apply for the ERC, businesses should diligently prepare their financial records, consult IRS guidance, and engage with ERC experts who can provide valuable insights. By filing the ERC tax credit application, Form 941-X, promptly and thoroughly, businesses enhance their chances of a smooth process without delays or potential audits. Upholding the principles of accuracy and completeness, alongside maintaining organized documentation for at least four years, will contribute to a robust ERC claim.

While the ERC serves as a vital stimulus program, it is essential for business owners to explore other available relief options, such as the Paycheck Protection Program (PPP), the Economic Injury Disaster Loan (EIDL), and the Work Opportunity Tax Credit (WOTC). By understanding the distinctions and synergies among these programs, entrepreneurs can maximize their benefits and support their businesses' recovery.

In conclusion, during these challenging times, it is crucial for business owners to leverage all available resources to sustain their operations and support their employees. The ERC stands as a valuable tool, offering financial relief to those who meet the eligibility criteria. By harnessing the information provided in this article, businesses can navigate the ERC application process with confidence, securing the support they need to overcome the hurdles presented by the ongoing pandemic.

© 2023 Applyforerconline.com. All Rights Reserved.